XRP Price Prediction: ETF Launch and Technical Signals Suggest Breakout Potential

#XRP

- Technical Strength: MACD and Bollinger Bands suggest upside potential

- ETF Catalyst: Historic approval driving institutional inflows

- Supply Dynamics: Large exchange withdrawals reduce selling pressure

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Upside

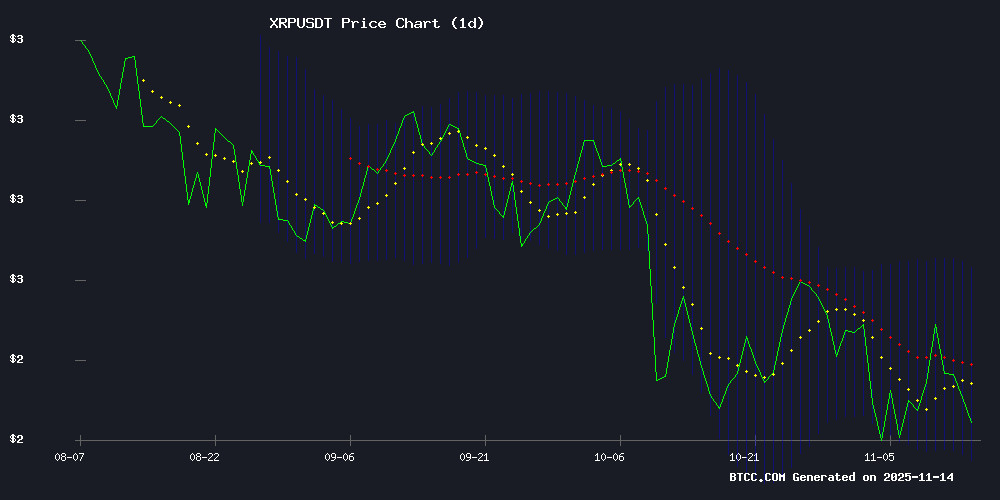

According to BTCC financial analyst Emma, XRP is currently trading at $2.2646, slightly below its 20-day moving average of $2.4173. The MACD indicator shows bullish momentum with a positive histogram (0.0342), suggesting potential upward movement. Bollinger Bands indicate the price is NEAR the lower band ($2.1490), which could signal a buying opportunity if support holds.

XRP Market Sentiment: ETF Launch Sparks Bullish Momentum

BTCC financial analyst Emma notes that the launch of the first U.S. spot XRP ETF has generated significant market excitement, with $26M in volume within 30 minutes. The approval marks a historic milestone, while large withdrawals (149M XRP) from exchanges suggest growing investor confidence. These developments, combined with the $10B inflow into Ripple, create a favorable sentiment for XRP's price appreciation.

Factors Influencing XRP’s Price

$10 Billion Floods Into Ripple (XRP): ETF Launch Sparks Volatility

Ripple's XRP surged 8% to $2.52 after a $10 billion market cap influx following the Nasdaq debut of the Canary XRP ETF (XRPC) - the first US spot ETF with direct XRP exposure. The rally proved short-lived as prices collapsed to $2.20 within hours, highlighting crypto's notorious volatility.

Bloomberg data shows $26 million traded in the ETF's first 30 minutes, but the instrument failed to sustain momentum. Analysts remain skeptical about XRP reaching $3, with CoinCodex projections suggesting more modest upside. The whipsaw action underscores the high-risk nature of crypto markets, where institutional products don't always translate to sustained price appreciation.

XRP ETF Approval Marks Historic Milestone Amid Market Volatility

XRP enters a transformative phase as regulatory approval for Canary Capital's spot ETF clears the path for Nasdaq listing under ticker XRPC. The November 13 launch represents a watershed moment for Ripple's ecosystem and institutional crypto adoption, overcoming years of legal scrutiny.

Whale accumulation patterns have shifted abruptly following the announcement, with CryptoQuant data revealing front-running activity before retail traders flooded in. Despite short-term price pressure from macroeconomic headwinds and profit-taking, analysts anticipate the ETF will catalyze liquidity and stabilize sentiment.

The breakthrough comes as the broader crypto market faces selling pressure, positioning XRP as an outlier in regulatory progress. Trading volume patterns on major exchanges now hinge on XRPC's debut performance - a litmus test for altcoin ETF viability after Bitcoin and Ethereum products.

149 Million XRP Exit Crypto Exchanges In One Day, What’s Going On?

Centralized exchanges have seen a sharp decline in XRP holdings, with over 149 million tokens—worth approximately $336 million—withdrawn within 24 hours. This movement suggests investors are shifting assets to private storage rather than preparing for liquidation.

The timing aligns with heightened speculation around a potential Spot XRP ETF launch in the U.S. this week. Exchange reserves now stand at $6.63 billion, marking one of the most significant single-day outflows in recent months.

Market conditions remain volatile, but accumulation trends are strengthening. The withdrawal of 2% of available supply raises questions about where the liquidity is headed, as anticipation builds for regulatory developments.

XRP Price Prediction: First U.S. Spot ETF Goes Live Today – Breakout to $100 Starting?

The first U.S. spot exchange-traded fund (ETF) tied to XRP debuts today, signaling a pivotal moment for institutional adoption. Canary Capital's XRPC ETF, approved by the SEC, will trade on Nasdaq. Wall Street's appetite for XRP is evident, with REX-Osprey's hybrid ETF already attracting $131 million in assets.

XRP's price stability at $2.10, bolstered by the end of the U.S. government shutdown, hints at a potential rally. A break above the 200-day EMA could propel the token toward $3, with institutional inflows fueling longer-term targets of $5 or beyond.

Market Expert Unveils XRP ETF Launch Timeline and Fee Structure

Paul Barron, a prominent market analyst, has disclosed a comprehensive calendar for upcoming XRP ETF launches, detailing management fees and expected rollout dates. Canary Capital leads the charge with its '33 Act XRP ETF debut today, featuring a 0.50% fee—Nasdaq has already greenlit the listing.

Franklin Templeton follows mid-November (14th–18th), while Bitwise enters the fray on November 19th–20th with a competitive 0.34% fee. Grayscale, 21Shares, and CoinShares target late November launches, with WisdomTree rounding out the cohort. Bloomberg's Eric Balchunas confirms Nasdaq's formal approval of Canary's XRPC marks the final pre-launch milestone.

BNY Launches Stablecoin Reserves Fund Ahead of GENIUS Act Implementation

BNY Mellon has introduced the BNY Dreyfus Stablecoin Reserves Fund (BSRXX), a money-market vehicle tailored for stablecoin issuers preparing for compliance with the forthcoming GENIUS Act. The fund exclusively invests in short-term securities with maturities under 93 days—aligning with the Act's mandate for 'ultra-safe, highly liquid' reserves like Treasuries and cash equivalents.

Stephanie Pierce, BNY's deputy head of investments, emphasized the fund's early availability despite the pending legislation. The structure diverges from traditional money-market funds by imposing stricter duration limits to address liquidity risks inherent in stablecoin reserve management.

Notably, BNY already custodies reserves for major stablecoin players like Circle and Ripple. The MOVE signals institutional readiness to bridge regulatory requirements with yield opportunities, as the GENIUS Act enforces 1:1 reserve backing for dollar-pegged tokens.

First U.S. Spot XRP ETF Launches With $26M Volume in 30 Minutes

The launch of Canary Capital's XRP-focused ETF (XRPC) has ignited bullish sentiment in the crypto market, recording $26 million in trading volume within its first 30 minutes. Bloomberg ETF analyst Eric Balchunas noted the debut could surpass $BSOL's $57 million Day One volume, signaling strong institutional demand for regulated XRP exposure.

XRP price surged 3% to $2.40 following the announcement, with daily trading volume spiking 34% to $6.24 billion. Bitwise CIO Matt Hougan praised the move as a watershed moment for crypto ETFs, reflecting growing mainstream acceptance of digital assets.

Is XRP a good investment?

Based on current technical and fundamental factors, XRP presents a compelling investment opportunity. Below is a summary of key data:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $2.2646 | Below 20-day MA ($2.4173) |

| MACD Histogram | +0.0342 | Bullish momentum |

| Bollinger Bands | Lower: $2.1490 | Potential support level |

| ETF Volume | $26M (30min) | Strong institutional interest |

Emma highlights that the combination of technical oversold conditions and bullish ETF-driven fundamentals could propel XRP toward higher price targets.